What is Meta Trader 4 ?

From Wikipedia, the free encyclopedia

| Developer(s) | Metaquotes Software Corp. |

|---|---|

| Operating system | Windows, Android, iOS[1] |

| Type | Trading platform, Technical analysis software |

| License | Metaquotes Software Corp. |

| Website | www.metaquotes.net/en/metatrader4 |

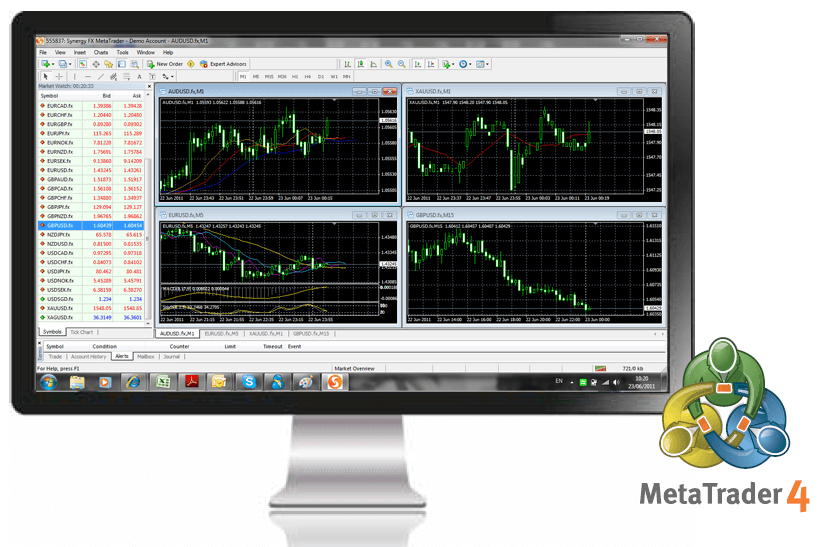

MetaTrader 4, also known as MT4, is an electronic trading platform widely used by online retail foreign exchange speculative traders. It was developed by MetaQuotes Software and released in 2005. The software is licensed to foreign exchange brokers who provide the software to their clients. The software consists of both a client and server component. The server component is run by the broker and the client software is provided to the broker’s customers, who use it to see live streaming prices and charts, to place orders, and to manage their accounts.

The client is a Microsoft Windows-based application that became popular mainly due to the ability for end users to write their own trading scripts and robots that could automate trading. In 2010, MetaQuotes released a successor, MetaTrader 5. However, uptake was slow and as of April 2013 most brokers still used MT4. While there is no official MetaTrader 4 version available for Mac OS, some brokers provide their own custom developed MT4 variants for Mac OS.

Metatrader is also available for mobile and supports Android, iOS and Windows mobile.

Functionality

The client terminal includes a built-in editor and compiler with access to a user contributed free library of software, articles and help. The software uses a proprietary scripting language, MQL4/MQL5, which enables traders to develop Expert Advisors, custom indicators and scripts. MetaTrader’s popularity largely stems from its support of algorithmic trading.

MT4 is designed to be used as a stand-alone system with the broker manually managing their position and this is a common configuration used by brokers. However, a number of third party developers have written software bridges enabling integration with other financial trading systems for automatic hedging of positions. In late 2012 and early 2013, MetaQuotes Software began to work towards removing third-party plugins for its software from the market, suing and warning developers and brokers.

MetaTrader provide two types of trading orders, Pending Orders and Market Orders. Pending orders will be executed only when the price reaches a predefined level, whereas Market orders can be executed in one of the four modes: Instant execution, Request execution, Market execution, and Exchange execution. With Instant execution, the order will be executed at the price displayed in the platform. Its advantage is that the order will be executed at a known price. However, a good trading opportunity can be missed when the volatility is high and the requested price cannot be served. Request execution mode enables trader to execute a Market order in two steps — first, a price quote is requested, then, a trader decides whether to buy or sell using the received price. A trader has several seconds to decide if the received price is worth trading. Such mode offers a certain knowledge of price combined with guaranteed execution at that price. The tradeoff is the reduced speed of execution, which can take a lot longer than other modes. With Market execution, the orders will be executed with broker’s price even if it is different from that displayed in the platform. The advantage of this mode is that it allows trading without any sort of requotes. However, deviation can get considerable during volatile price changes. In Exchange execution mode, the order is processed by the external execution facility (the exchange). The trade is executed according to the current depth of market.